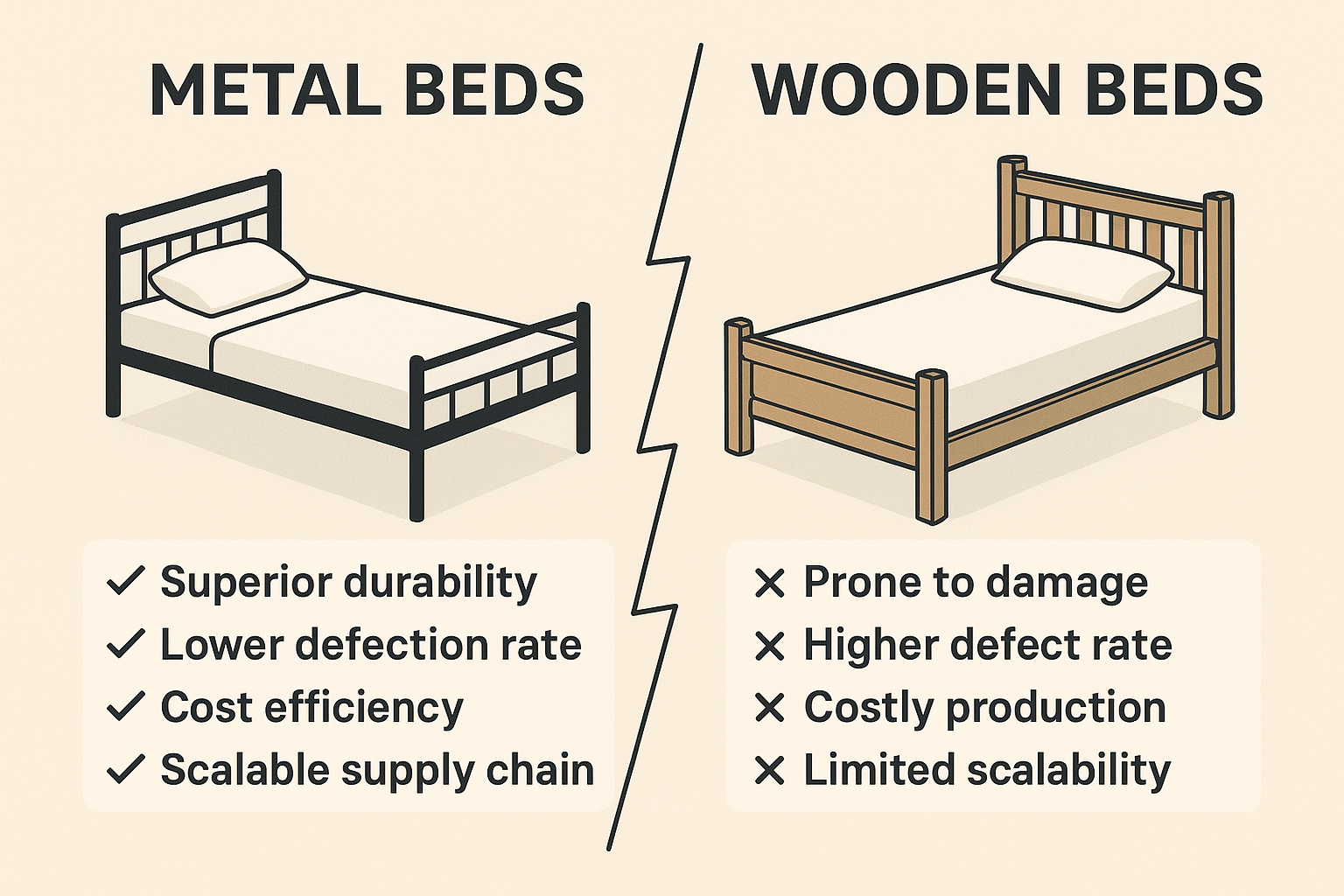

За останні кілька років на світовому ринку меблів спостерігається явна зміна в поведінці покупців, особливо серед клієнтів B2B, таких як дистриб'ютори, оптовики, бренди електронної комерції та підрядники проектів. Металеві ліжка швидко завоювали домінування над традиційними дерев'яними ліжками, стаючи кращим вибором для закупівель великих обсягів. Ця тенденція зумовлена не лише характеристиками продукту, але й тим, як металеві ліжка відповідають сучасним вимогам.'вимоги ланцюга поставок, цілі сталого розвитку та зміна очікувань споживачів.

1. Чудова міцність та структурна стабільність

Покупці B2B постійно виділяють довговічність як найважливіший фактор у зменшенні кількості повернень та проблем після продажу. Металеві ліжка пропонують:

Більша вантажопідйомність

Стійкість до вологості, комах та перепадів температур

Мінімальна деформація або розтріскування

Довший термін служби виробу

На відміну від них, дерев'яні ліжка—особливо конструкції з МДФ або ДСП—більш вразливі до вологи, набухання та пошкоджень під час транспортування. Для міжнародних перевезень та тривалого використання в орендованих квартирах, гуртожитках або хостелах металеві каркаси забезпечують набагато більшу надійність.

2. Нижчий рівень браку та безпечніша доставка

Для міжнародних покупців, особливо тих, хто здійснює доставку до Європи та Північної Америки, низький рівень браку безпосередньо пов'язаний з прибутковістю. Металеві ліжка мають значні переваги:

Менша ймовірність пошкодження панелі

Посилений захист під час транспортування

Менше відсутніх або невідповідних деталей

Більш послідовний контроль якості

Дерев'яні меблі, особливо великі конструкції, більш схильні до пошкодження країв, подряпин на поверхні та поломок—проблеми, які стають дороговартісними для продавців та дистриб'юторів транскордонної електронної комерції.

3. Ефективність витрат у виробництві та логістиці

Одним із найсильніших факторів, що впливають на тенденцію металевих ліжок, є економічна ефективність. Металеві ліжка мають такі переваги:

Автоматизовані зварювальні лінії

Порошкове покриття з низьким рівнем браку

Плоскі упаковки, що зменшують обсяг доставки

Менша трудомісткість, ніж у деревообробці

Дерев'яні ліжка вимагають більше ручних операцій, точного різання, шліфування та обробки поверхні, що робить їх виробництво дорожчим та трудомістким. Для покупців B2B, які орієнтовані на стабільну прибутковість, металеві ліжка пропонують більш передбачувану структуру витрат.

4. Зростаючий попит з боку світової електронної комерції

Металеві ліжка стали однією з найпопулярніших категорій на Amazon, Wayfair, Shopee та Lazada. Їхнє зростання на онлайн-платформах зумовлене:

Чітка та проста структура продукту

Висока точність складання

Зниження ризиків післяпродажного обслуговування

Стабільні оцінки користувачів

Продавці електронної комерції віддають перевагу продуктам з меншою кількістю скарг та надійнішим захистом упаковки—дві сфери, де металеві ліжка значно перевершують дерев'яні. Оскільки все більше брендів створюють довгострокові онлайн-портфоліо, металеві ліжка стають важливою категорією.

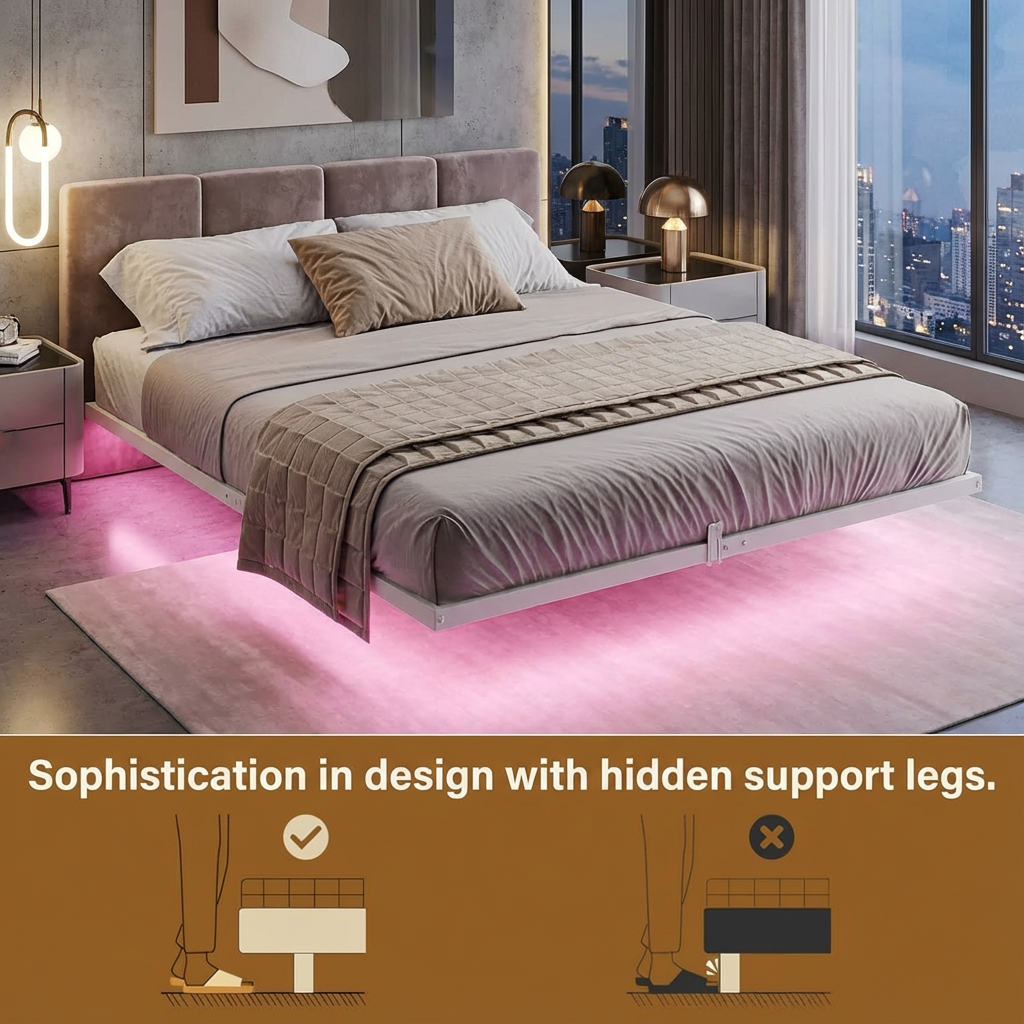

5. Краща адаптація до сучасних та мінімалістичних дизайнерських тенденцій

Металеві ліжка зараз бувають різних стилів, таких як:

Мінімалістичні чорні рамки

Скандинавські комбінації сталі та дерева

Індустріальне ретро-оздоблення

М'які гібридні конструкції

Їхня універсальність дозволяє клієнтам B2B орієнтуватися на кілька сегментів за допомогою однієї лінійки продуктів. Металеві конструкції також спрощують створення модульних конструкцій, додавання місця для зберігання або інтеграцію безшумних ламелей.—характеристики, що зростають у міських споживачів.

6. Сталий розвиток та переробка

Сталий розвиток став стандартною вимогою в закупівлях. Металеві ліжка краще відповідають цілям ESG, оскільки:

Сталь повністю придатна для переробки

Порошкове покриття зменшує хімічні відходи

Металеві меблі мають довші цикли заміни

Дерев'яні меблі, особливо з використанням інженерних плит, мають більший вплив на навколишнє середовище через клеї, контроль формальдегіду та обмежену можливість переробки. Для імпортерів, які цінують екологічний брендинг, металеві меблі сприяють довгостроковому позиціонуванню.

7. Більша персоналізація та потенціал приватної торгової марки

Металеві ліжка пропонують високу гнучкість для брендів, які прагнуть створити диференційовані SKU:

Індивідуальні кольори та оздоблення

Унікальний дизайн узголів'я або узніжжя ліжка

Шумопоглинаючі конструкції

Гравіювання логотипу або упаковка під власною торговою маркою

Системи ламелей, адаптовані до потреб ринку

Для покупців, які розробляють ексклюзивні моделі для Amazon, Wayfair, платформ B2B або офлайн-каналів, металеві ліжка забезпечують більшу свободу дизайну та нижчу вартість інструментів порівняно з дерев'яними виробами.

8. Більш стабільний та масштабований ланцюг поставок

Виробництво металевих ліжок є дуже масштабованим. Автоматизовані складальні лінії дозволяють заводам:

Ефективна доставка великих обсягів

Підтримуйте стабільні терміни виконання замовлень

Підтримуйте довгострокові проектні зобов'язання

Обробляємо замовлення в пік сезону без затримок

Натомість виробництво дерев'яних ліжок більше залежить від ручної роботи та коливань поставок деревини. Це робить металеві ліжка більш безпечним вибором для покупців, які надають пріоритет передбачуваній доставці.

Покупці B2B все частіше віддають перевагу металевим ліжкам, оскільки вони забезпечують ідеальний баланс довговічності, економічної ефективності, масштабованості та адаптивності до ринку. Оскільки світове споживання зміщується в бік доступних, довговічних та простих у складанні меблів, металеві ліжка тісно відповідають як потребам клієнтів, так і реаліям сучасного ланцюга поставок.

Для імпортерів, дистриб'юторів та брендів електронної комерції, які прагнуть створити стабільний та прибутковий портфель меблів, металеві ліжка залишаються однією з найбільш стратегічних категорій продуктів останніх років.—і продовжуватиме лідирувати на ринку в наступні роки.